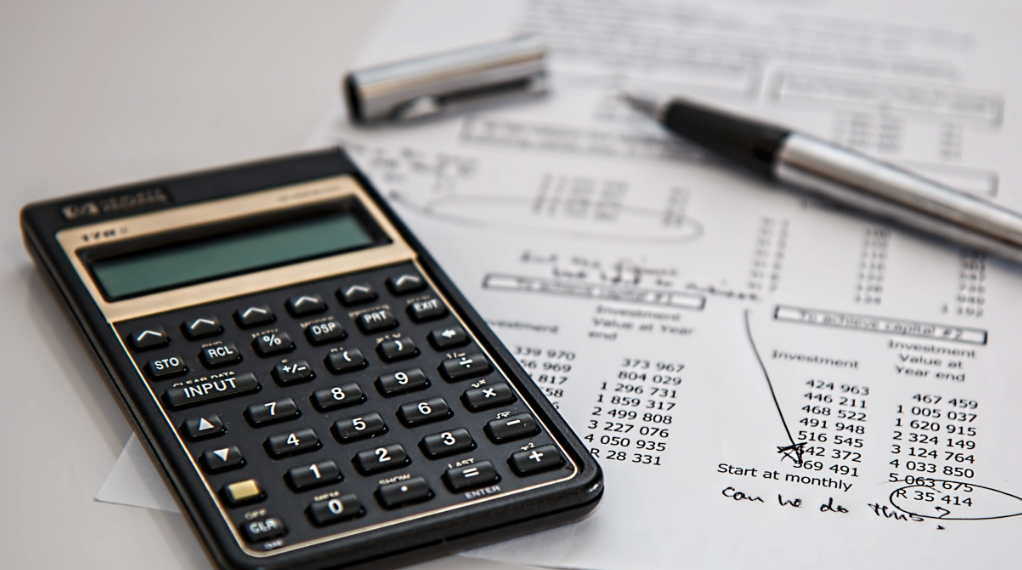

Hiring a tradies accountant is crucial for managing the financial aspects of a tradesperson’s business. Their specialised knowledge ensures that tradies can focus on their work without worrying about their finances.

Here are five key responsibilities of a tradies accountant.

1. Bookkeeping and Financial Record Keeping

A tradies accountant ensures all financial transactions are recorded accurately and systematically. This includes tracking income, expenses, invoices, and receipts. Proper bookkeeping is essential for creating reliable financial statements, which provide a clear picture of the business’s financial health. Accurate records also make it easier to identify financial trends and areas that need improvement.

2. Tax Preparation and Compliance

One of the most critical responsibilities of a tradies accountant is managing tax-related matters. They ensure that all tax returns are filed accurately and on time, helping to avoid penalties and fines. Their expertise in tax regulations, including taxation in Geelong, ensures compliance with local, state, and federal tax laws.

3. Cash Flow Management

Effective cash flow management is vital for any business, especially for tradies who often deal with fluctuating income and expenses. A tradies accountant monitors cash flow patterns, helps maintain adequate liquidity, and provides strategies to manage cash effectively. This ensures that the business can meet its financial obligations, invest in growth opportunities, and handle unexpected expenses without financial strain.

4. Financial Reporting and Analysis

Regular financial reporting is essential for tracking a business’s performance and making informed decisions. A tradies accountant prepares detailed financial reports, such as profit and loss statements, balance sheets, and cash flow statements. They also analyse these reports to identify trends, strengths, and weaknesses.

5. Business Advisory Services

Beyond basic accounting tasks, a tradies accountant offers business advisory services tailored to the specific needs of tradespeople. They guide budgeting, financial planning, and growth strategies. Their understanding of the unique challenges faced by tradies enables them to offer practical advice on managing finances, investing in new equipment, and expanding the business.

A tradies accountant plays a vital role in managing the financial aspects of a tradesperson’s business. From bookkeeping and tax compliance to cash flow management, financial reporting, and business advisory services, their expertise ensures that tradies can focus on their work while maintaining financial health. Partnering with a skilled accountant provides peace of mind and a solid foundation for business growth.

Home

Home