Owning a motorcycle can be a thrilling experience. The freedom, the speed, and the adrenaline rush are unparalleled. However, not everyone has the financial means to buy a bike outright. That’s where a personal bike loan comes in. It’s a convenient solution that helps you finance your dream ride without breaking the bank. Here’s how you can get a loan that fits your budget.

Assess Your Financial Situation

Before applying for a loan, it’s crucial to understand your financial standing. Check your credit score as it plays a significant role in determining the interest rate you’ll receive. A higher credit score can lead to lower interest rates, making the loan more affordable.

Determine Your Budget

Next, ascertain how much you can afford to borrow and repay every month. This step involves considering your monthly income, expenses, and any other financial commitments. Remember, you don’t want to stretch yourself too thin.

Select Your Motorcycle

The type of motorcycle you choose will significantly affect your loan amount. Whether it’s a brand-new or a used bike, the price can vary drastically. Make sure your choice aligns with your budget.

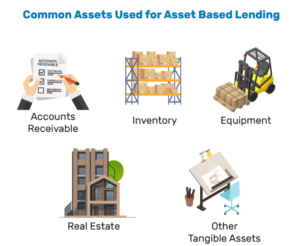

Look at Different Loan Options

There are various types of loans available, ranging from secured to unsecured loans. Secured loans often offer lower interest rates but require collateral, while unsecured loans don’t require collateral but may have higher interest rates. Research and compare these options to find what best suits your needs.

Use the Bike Loan Repayment Calculator

To help understand how much you’ll need to repay every month, consider using a bike loan repayment calculator. This tool can provide an estimate of your monthly repayments based on the loan amount, interest rate, and loan term. It’s a handy way to gauge whether the loan is within your budget or not.

Apply to Multiple Lenders

Don’t limit yourself to just one lender. Apply to multiple lenders to increase your chances of getting approved and to compare the rates and terms offered by each. This step can help you secure the best deal for your situation.

Close Your Loan

Once you’ve found the loan that meets your needs and received approval, it’s time to close the loan. Ensure you read and understand all the terms and conditions before signing the contract.

Conclusion

Getting a personal bike loan doesn’t have to be a complicated process. By understanding your financial situation, determining your budget, choosing the right motorcycle, exploring different loan options, and using calculators, you can secure a loan that fits your budget.

Home

Home