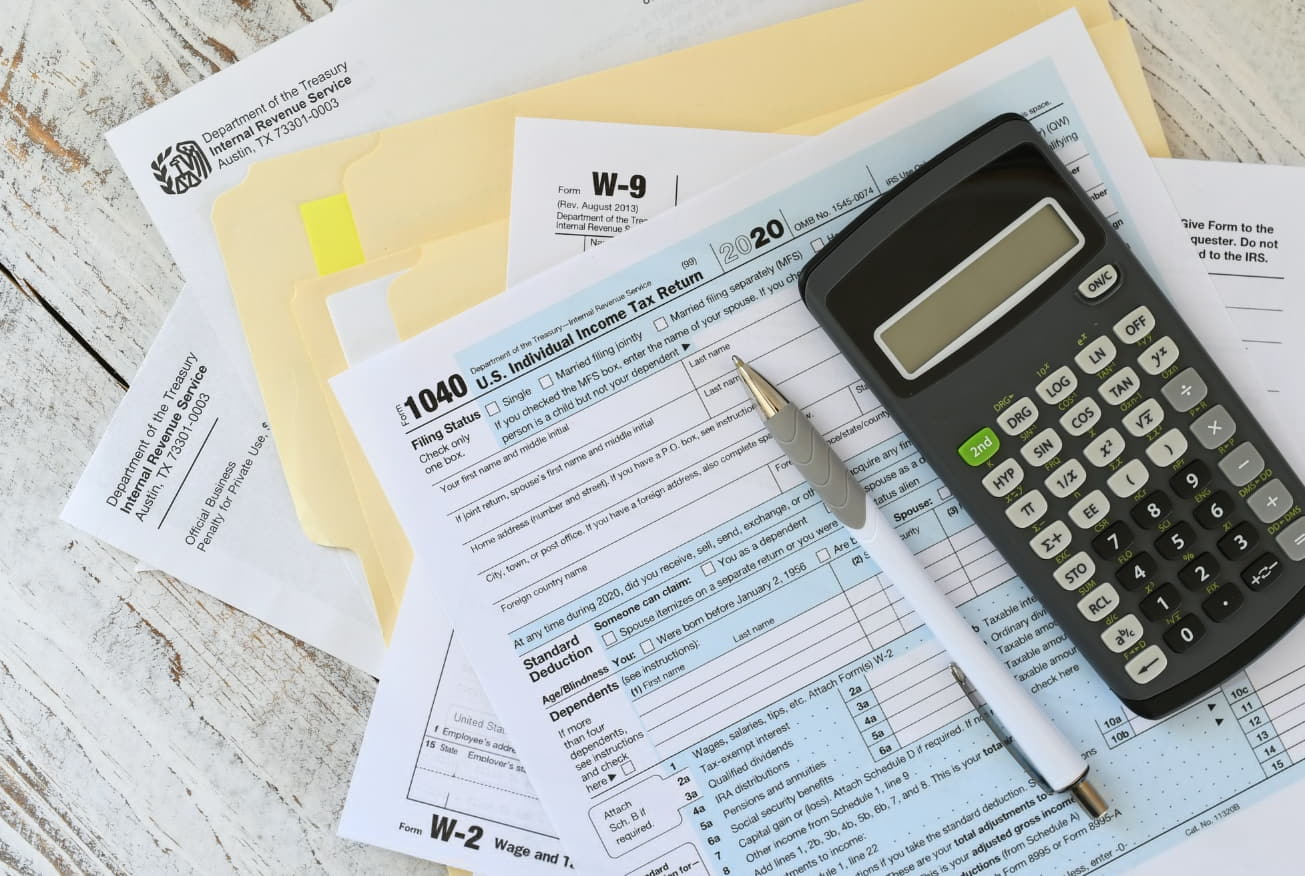

It can be overwhelming to manage your tax submissions as you need to face ever-changing tax laws. You need assistance to handle your tax filing or submissions. Try to ask a personal income tax accountant to help you with the best services to save you time. The reason behind hiring these experts is to fulfill your obligations efficiently. Once you have decided to submit your tax returns then the next thing is to check for their expertise. Various advantages are linked with working with a professional.

Better Tax Understandings

A professional tax accountant is essential for everyone to handle their financial obligations. They can handle your tax submissions more efficiently. The entire process of opting for the services of these experts is to fulfill your obligations without having fear of paying more taxes.

Structure Financial Affairs

These experts will advise you on how to structure your financial dealings. When you understand the complexities and regulations then it will become much easier for you to understand the need for financial assistance. You need to submit your taxes with accuracy and ensure correctness in tax dues.

Minimize Your Tax Liability

Another major advantage of opting for an income tax accountant is to minimize your tax liabilities and maximize your savings. The best thing about these experts is that they know how to identify opportunities that can save taxes for you. You can add more retirement contributions and investment strategies to create long-term plans for the future.

Secure Your Financial Future

The approach to planning your taxes will give you a chance to secure your financial future. You can avoid surprises in tax season and ensure you are taking advantage of all possible benefits. Those who do not know anything about tax submissions can try to save their time by hiring a professional in this field. A tax specialist cannot only control your tax situation but also secure your future as you do not want to pay more taxes.

Avoid Penalties

A personal income tax accountant can submit your tax returns free from errors. If you do not pay attention to errors then it will lead you to penalties. The things that can be handled for your taxes should be submitted correctly otherwise you have to face issues to manage your taxes. A small-scale business owner should also focus on legal requirements and hire a professional with tax expertise to avoid penalties.

Home

Home